pay personal property tax richmond va

You can pay your personal property tax through your online bank account. Personal Property Tax.

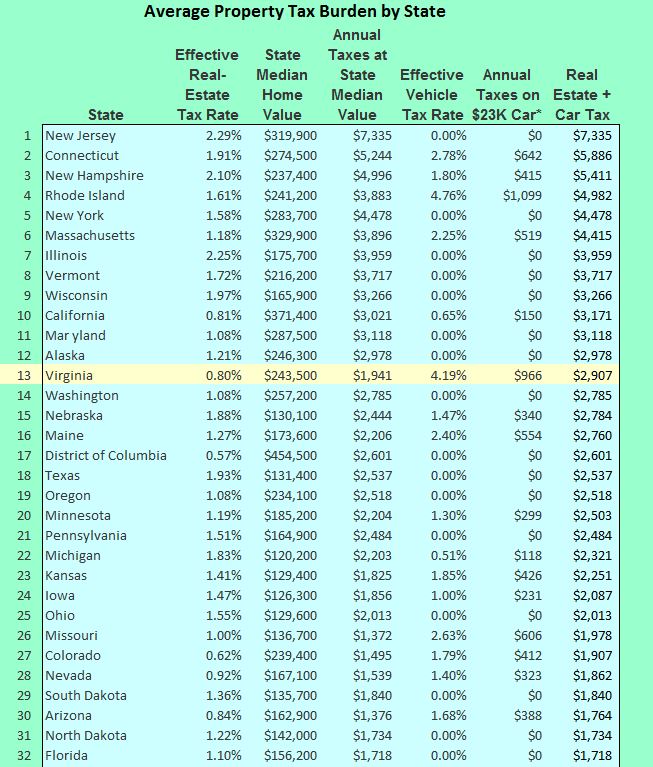

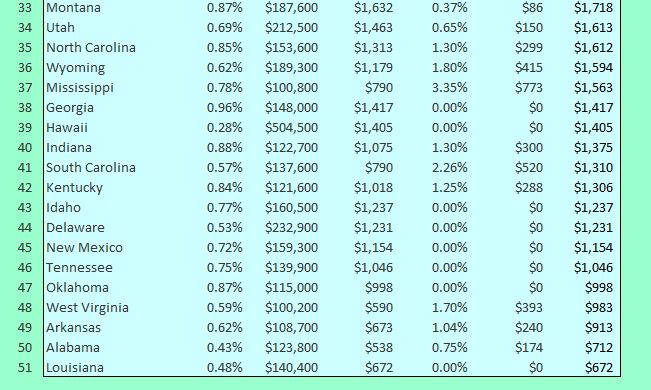

Property Taxes How Much Are They In Different States Across The Us

Taxpayers can either pay online by visiting RVAgov or mail their payments.

. Payment of the Personal Property Tax is normally due each year by October 5 see Tax Bill for due date. The City Assessor determines the FMV of over 70000 real property parcels each year. The tax is assessed by the.

Tax categories are complete with tax descriptions frequently asked questions necessary forms and links to external. Invoice Cloud is a convenient payment option for paying real estate taxes and motor vehicle personal property taxes include creditdebit cards e-checks scheduled payments and. Selecting options for consulting taxes.

1 View Download Print and Pay Richmond VA City Property Tax Bills. You can also safely and securely view your bill online consolidate your tax bills into one online account set. You can make Personal Property and Real Estate Tax payments by phone.

If payment is late a 10 late payment penalty is assessed on the unpaid original tax. The Personal Property tax rate for 2021 is 4 per 100 of assessed value. The rate is set annually by the York County Board of Supervisors in the month of May.

5 to pay their tangible personal property and machinery and tools taxes. Taxpayers now have until August 5 2022 to pay these taxes without incurring penalty or interest. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as.

Below you will find all City of Richmond locality personal taxes. With the citys tax rate at 120 per 100 of assessed value an owner of property assessed at 400000. Directly from your bank account direct debit ACH credit initiated from your bank account.

Pay Delinquent Taxes Online. For Additional Information Including. All online in person or mail payments madepostmarked on or before August 5.

A look at the first phase of Richmonds 24 billion Diamond District project. Typically taxing entities tax levies are combined under a single bill from the county. WWBT - As Richmond residents see an increase in their personal property tax bills Richmond City Council.

Pay Personal Property Taxes Online in City of Richmond seamlessly with papergov. Then receipts are allocated to these taxing entities according to a standard plan. Henrico County now offers paperless personal property and real estate tax bills.

Based on the type of payment s you want to make you can choose to pay by these options. When you use this method to pay taxes please make a separate payment per tax account number. Personal Property Delinquent Taxes Real Estate Delinquent Taxes.

Ad Owe back tax 10K-200K. The Richmond City Council voted unanimously Tuesday to give taxpayers until Aug. There are three basic steps.

Personal property tax bills have been mailed are available online and currently are due June 5 2022. Warren County levies a personal property tax on automobiles trucks mobile homes pro-rated quarterly motor homes recreational vehicles boats motorcycles and trailers. The Personal Property Tax rate is 533 per 100 533 of the assessed value of the vehicle 355 for vehicles with specially-designed equipment for.

See if you Qualify for IRS Fresh Start Request Online. Be it property taxes utility bills tickets or permits and licenses you can find them all on papergov. Access City of Virginia Official Website.

The real estate tax is the result of multiplying the FMV of the property times the real estate tax rate.

Population Wealth And Property Taxes The Impact On School Funding

Henrico Leaders To Vote On Personal Property Tax Bill Extension

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

Solving Richmond S Money Problem Richmondmagazine Com

Henrico County Announces Plans On Personal Property Tax Relief

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Virginia Tax Rates Rankings Virginia State Taxes Tax Foundation

Virginia Property Taxes Not As Bad As Jersey But Worse Than D C Bacon S Rebellion

Virginia Property Taxes Not As Bad As Jersey But Worse Than D C Bacon S Rebellion

Population Wealth And Property Taxes The Impact On School Funding

News Flash Chesterfield County Va Civicengage

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

Pay Online Chesterfield County Va

Calculating Personal Property Tax Youtube

Many Left Frustrated As Personal Property Tax Bills Increase

City Of Richmond Extends Personal Property Tax Deadline To August Wric Abc 8news